Discover US P2P lending platforms

In recent years, the financial sector has undergone a deep transformation thanks to the advancement of technology and the digitalization of services. Among these innovations, P2P lending (peer to peer lending) platforms stand out as a practical and accessible alternative for both borrowers and investors.

But what exactly are these platforms and which are the main ones in the United States? Follow the content until the end and check out all the details!

What is P2P lending?

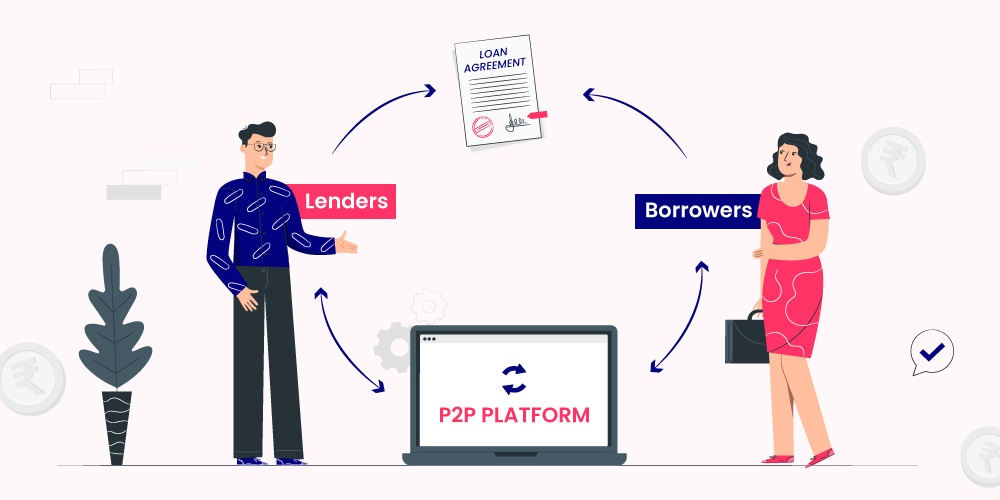

P2P lending is a financial model that connects people who need money with investors willing to lend it, without the involvement of a traditional bank.

Everything happens online through specialized platforms that handle risk analysis, contract processing, and payments.

For borrowers, P2P lending can offer lower interest rates and less bureaucracy. For investors, it provides the opportunity to earn attractive returns, although risks exist, particularly the risk of default.

With the model’s growing popularity, several platforms have emerged in the U.S. Below are some of the main ones.

1. LendingClub

LendingClub is one of the largest and oldest P2P lending platforms in the U.S., founded in 2006.

Initially focused on directly connecting investors to borrowers, it has since evolved and now operates as a regulated financial institution.

The platform mainly offers personal loans and debt consolidation, with competitive interest rates. While LendingClub still allows investment options, the focus today is more on institutional investors.

Highlights:

- Loan amounts: $1,000 to $40,000;

- Terms: up to 5 years;

- Interest rates starting at 8% (depending on the borrower’s profile);

2. Prosper

Prosper was the first P2P lending platform in the U.S., launched in 2005. It maintains its original model, directly connecting borrowers and individual investors.

The company offers personal loans for various purposes, such as home renovation, debt consolidation, education, or medical expenses.

Highlights:

- Loan amounts: $2,000 to $50,000;

- Terms: 3 or 5 years;

- Interest rates: between 6.99% and 35.99% annually;

- Investment possible with as little as $25 per note (loan note).

3. Upstart

Founded by former Google employees, Upstart stands out for its advanced use of artificial intelligence in credit evaluation.

Rather than focusing only on traditional credit scores, it considers factors like education, work history, and even online behavior.

This allows Upstart to approve borrowers who might be rejected elsewhere, with calculated risk. The platform specializes in personal loans, especially for younger people with limited credit history.

Highlights:

- Loans from $1,000 to $50,000;

- Terms: 3 or 5 years;

- Fast approval (sometimes within 24 hours);

- Ideal for people with strong potential but limited credit history.

4. Funding Circle

Funding Circle focuses specifically on small businesses, connecting entrepreneurs with investors looking to lend to promising ventures.

The company operates with a hybrid model, offering both P2P and institutional funding options.

It’s a great choice for business owners who struggle to get loans from traditional banks but have solid backgrounds and growth plans.

Highlights:

- Loan amounts: $25,000 to $500,000;

- Terms: up to 7 years;

- Interest rates starting at 7.49%;

- Fast approval, often without requiring physical collateral.

5. Peerform

Peerform is a smaller platform but targets a specific audience: individuals with limited or poor credit scores.

The company uses its own algorithm to assess risk and connects these borrowers with investors willing to take on more risk in exchange for higher returns.

Highlights:

- Loan amounts: up to $25,000;

- Minimum credit score required: 600;

- Good for credit rebuilding;

- Appeals to experienced investors with higher risk tolerance.

Final Thoughts

The P2P lending market in the U.S. is one of the most developed in the world, offering diverse options for different borrower and investor profiles.

These platforms stand out for reducing barriers, streamlining processes, and offering more flexibility than traditional banks.

However, it’s important to remember that P2P lending involves risks, especially the risk of default, so diversification and a clear understanding of the platform’s conditions are essential before investing.

Whether you’re looking to borrow money or invest in a more dynamic way, exploring these platforms and comparing terms and rates is a smart move.