Understand what DAO based lending is

The financial world has been undergoing a major transformation in recent years, driven by blockchain technology and decentralized finance (DeFi). One of the most innovative solutions to emerge from this movement is DAO-based lending.

This new model of credit removes traditional intermediaries, empowers communities, and creates more transparent and accessible ways for people to borrow and lend money. But what exactly does this mean in practice? Let’s explore.

What is DAO-based Lending?

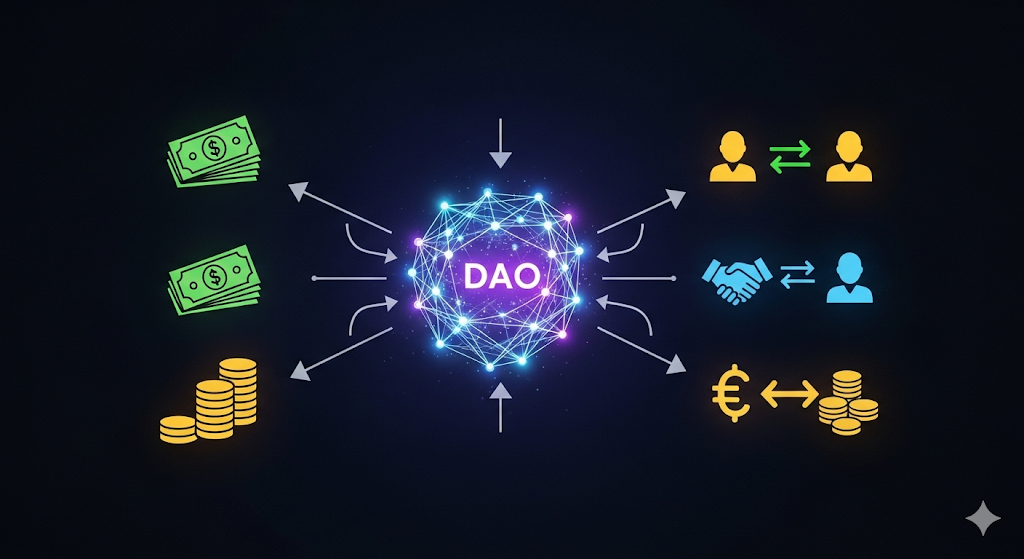

DAO stands for Decentralized Autonomous Organization. It is a structure built on blockchain, governed by smart contracts and community voting, rather than centralized authorities such as banks or financial institutions.

In the context of lending, a DAO serves as the “platform” where borrowing and lending activities occur.

Instead of relying on a bank to approve loans, the DAO sets rules coded into smart contracts.

These contracts define how much collateral is required, the interest rates, repayment terms, and what happens in case of default.

Everything is automated and transparent, which reduces bureaucracy and minimizes human error.

Simply put, DAO-based lending is a peer-to-peer credit system managed collectively by its members and enforced by technology, not by centralized intermediaries.

What is it For?

DAO-based lending has multiple purposes, and its impact goes beyond just offering an alternative to banks:

- Access to Credit in a Global Context

Many people around the world remain excluded from traditional financial systems. Without credit history or banking access, they are unable to borrow funds. - Community-Driven Capital Allocation

A DAO enables members to vote on lending parameters, supported projects, or even on creating special funds for certain causes. - Efficient and Transparent Credit Systems

Since the rules are predefined in smart contracts and transactions are recorded on a blockchain, there is complete transparency. - Innovation in Financial Products

Beyond personal loans, DAO-based lending can support more complex structures such as liquidity pools, credit markets for startups, or funding for sustainable projects.

What Are the Benefits?

The advantages of DAO-based lending stand out when compared to traditional lending systems. Here are the most relevant ones.

1. Decentralization and Autonomy

No single entity controls the lending process. Borrowers and lenders interact directly with the protocol, reducing dependency on banks and government institutions. This autonomy gives participants greater freedom to manage their finances.

2. Global Accessibility

Anyone with internet access and digital assets can participate. This makes DAO-based lending a global alternative, reaching individuals in regions underserved by traditional banking.

3. Reduced Costs

By eliminating intermediaries, DAOs reduce operational costs. This often translates into lower interest rates for borrowers and higher returns for lenders, making the system more attractive for both sides.

4. Transparency and Security

Every transaction is recorded on the blockchain, which ensures visibility and accountability. The use of smart contracts reduces risks of fraud, as terms are automatically executed without room for manipulation.

5. Community Governance

DAO members decide together how the system evolves. Through voting mechanisms, they can change lending parameters, create new credit lines, or adapt to market conditions. This flexibility strengthens the resilience of the system.

6. Incentives for Participation

Many DAOs reward users who contribute liquidity or participate in governance with tokens or other benefits. This creates a positive cycle where users are encouraged to engage actively with the system.

Challenges to Consider

While DAO-based lending offers many benefits, it also faces challenges. Volatility of cryptocurrencies used as collateral can affect loan stability.

Regulatory uncertainties in different countries may also create legal obstacles.

Additionally, users need a certain level of digital literacy to interact safely with blockchain platforms.

These challenges do not invalidate the model but highlight areas where innovation and regulation must evolve to ensure a secure and sustainable ecosystem.

Conclusion

DAO-based lending is not just a trend in the financial world, it represents a new way of thinking about credit, governance, and financial inclusion.

By removing intermediaries, it gives power back to communities and enables more people to access financial resources.

The model provides transparency, security, and global accessibility, while also opening room for innovation in financial products.

As the technology matures and regulations adapt, DAO-based lending may become one of the pillars of the future of finance, offering both individuals and organizations an alternative that is more democratic, efficient, and aligned with the principles of decentralization.